Foreign Direct Investment in the United States, 2020-2023

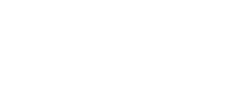

- Foreign direct investment in the United States (FDIUS) totaled $77 billion in the second-quarter 2023.

- Net equity flows registered $17 billion of the first-quarter 2023, composing 22 percent of FDIUS.

- Reinvestment of earnings was $56 billion last quarter, or 73 percent of all FDIUS.

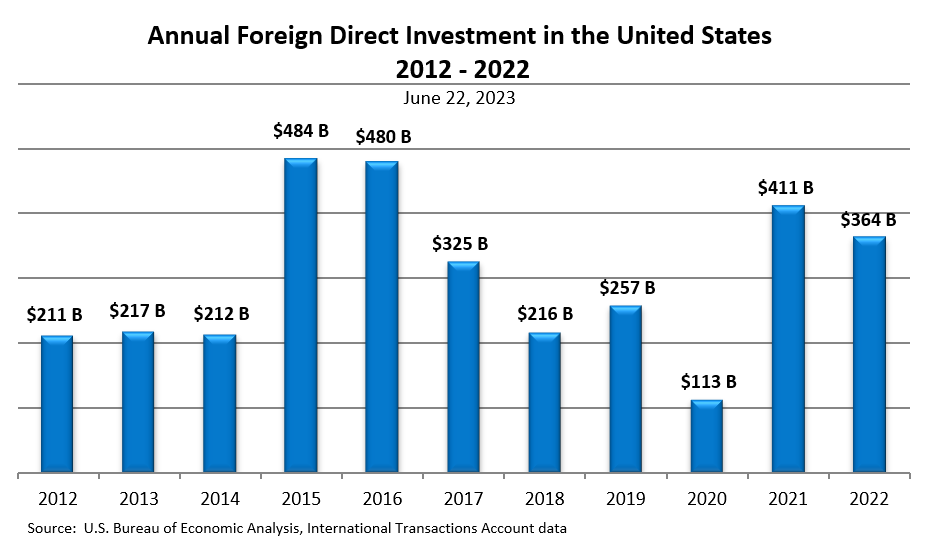

- Foreign direct investment in the United States in 2022 totaled $364 billion, making it the fourth-strongest year for FDIUS over the past decade. FDIUS reached record highs in 2015 and 2016, at $484 billion and $480 billion, respectively.

- Quarterly FDIUS flows are subject to large revisions and can fluctuate greatly from quarter to quarter.

- Despite increased global competition for foreign investment dollars as more countries position themselves as open and attractive investment destinations, the United States remains a prime investment market attracting capital and businesses to the United States that create new jobs across the American economy, bolster American innovation, and enhance American’s global competitiveness.

Analysis & Context

Second-quarter 2023 foreign direct investment flows in the United States totaled $77 billion, down 30 percent from first-quarter 2023. Reinvested earnings made up the largest portion of FDIUS at $56 billion, or nearly three-quarters of total FDIUS.

Japanese companies led in FDIUS during the second-quarter this year with nearly $12 billion, followed by companies from the United Kingdom and France.

At more than $35 billion, manufacturing was by far the largest industry benefitting from FDIUS in the last quarter. At the same time, wholesale trade and finance and insurance were the second- and third-largest domestic recipient industries of foreign direct investment.

Foreign direct investment in the United States totaled $364 billion in 2022. The 2022 FDIUS level is the fourth-strongest of the past decade, down 11 percent from 2021.

Globally, inward FDI flows fell 12 percent between 2021 and 2022 to $1.3 trillion, according to the United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2023 (WIR23). Some factors affecting this decline were the global pandemic, the war in Ukraine, climate change, and general economic uncertainty. Looking to the future, UNCTAD expects a further decline in FDI in 2023.