Foreign Direct Investment in the United States, 2020-2023[1]

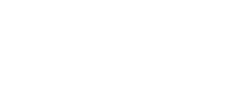

- Foreign direct investment in the United States (FDIUS)[2] totaled $109 billion in the first-quarter 2023.

- Net equity flows registered $63 billion of the first-quarter 2023, composing nearly 60 percent of FDIUS.

- Reinvestment of earnings were $51 billion last quarter.

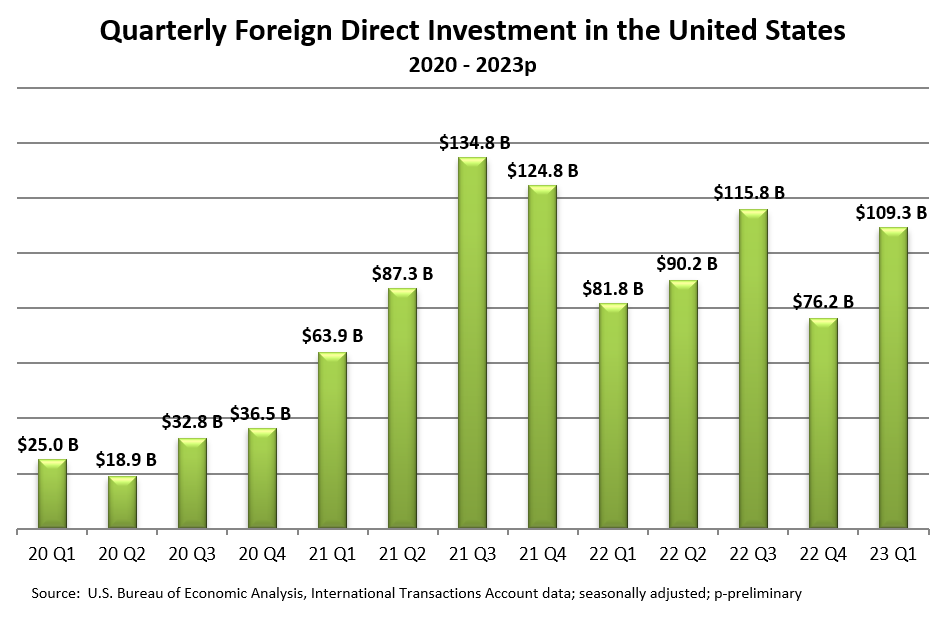

- Foreign direct investment in the United States in 2022 totaled $364 billion, making it the fourth-strongest year for FDIUS over the past decade. Two record-breaking years of FDIUS were recorded in 2015 and 2016, at $484 billion and $480 billion, respectively.

- Quarterly FDIUS flows are subject to large revisions and can fluctuate greatly from quarter to quarter. While the United States remains an attractive investment location, global competition for foreign investment dollars is increasing as more developing countries position themselves as investment destinations.

[1] The U.S. Bureau of Economic Analysis released preliminary 1st quarter 2023 foreign direct investment statistics on June 22, 2023.

[2] Foreign direct investment in the United States measures equity capital flows, reinvestment of earnings, and debt instruments between U.S. affiliates and their parents abroad.

Analysis & Context

First-quarter 2023 foreign direct investment flows in the United States started the year strong with $109 billion, up 43 percent from fourth-quarter 2022. Net equity flows made up the largest portion of FDIUS at $63 billion, or 58 percent of total FDIUS.

Foreign direct investment in the United States was revised upward to $364 billion in 2022. The 2022 FDIUS level is now the fourth-strongest of the past decade, down 11 percent from 2021.

While the United Nations Conference on Trade and Development (UNCTAD) has not yet released its worldwide FDI data for 2022, it noted several troubling trends, including negative or slow economic growth in many countries forecast for 2023 that likely will have a continued negative impact on global foreign direct investment this year.

Looking at foreign direct investment more broadly, international companies invest in the United States for many reasons. A list of positive factors includes the large U.S. market, world-class research universities, a stable regulatory regime, and a solid infrastructure that allows businesses to easily access the U.S. market. For certain international investors, the United States has become an important global export platform. Good domestic energy resources also draw international investors to the United States.

These investments benefit the American economy as international firms build new factories across the United States, buoy their well-established U.S. operations, fund American research and development activities, and employ 7.9 million Americans in well-paying jobs.