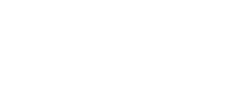

- Foreign direct investment in the United States (FDIUS) totaled $84 billion in the second-quarter 2024, up 28 percent over first-quarter 2024.

- Net equity flows registered $14 billion in the second-quarter 2024, composing 17 percent of FDIUS.

- Reinvestment of earnings stood at $55 billion in the second quarter of 2024, accounting for two-thirds of FDIUS.

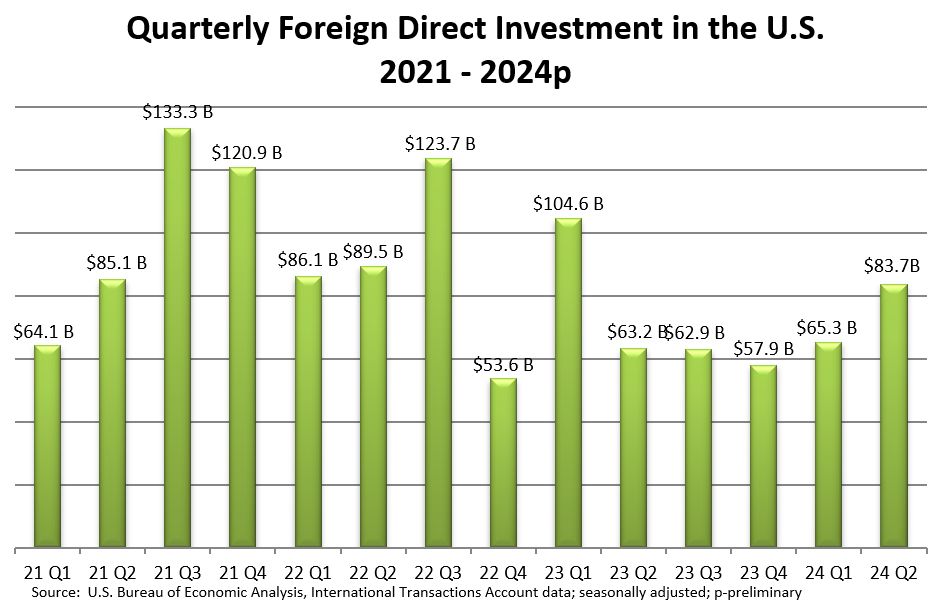

- Foreign direct investment in the United States in 2023 totaled $289 billion, making it the sixth-strongest year for FDIUS over the past decade. FDIUS reached record highs in 2015 and 2016, at $484 billion and $480 billion, respectively.

- Quarterly FDIUS flows are subject to large revisions and can fluctuate greatly from quarter to quarter.

- Despite increased global competition for foreign investment dollars as more countries position themselves as open and attractive investment destinations, the United States remains a prime investment market attracting capital and businesses to the United States that create new jobs across the American economy, bolster American innovation, and enhance American’s global competitiveness.

Analysis & Context

Second-quarter 2024 foreign direct investment flows in the United States totaled $84 billion, jumping nearly 30 percent from first-quarter 2024. Reinvested earnings during the same period made up the largest portion of FDIUS at $55 billion, or 66 percent of total FDIUS.

During the first six months of 2024, the United Kingdom, the Netherlands, Japan, Canada, and Germany led in FDIUS investment.

In the first six months of 2024, manufacturing led in FDIUS at $72 billion, followed by wholesale trade and finance at $21 billion and $15 billion, respectively.

Globally, inward FDI flows fell 2 percent between 2022 and 2023 to $1.3 trillion, according to the United Nations Conference on Trade and Development (UNCTAD). UNCTAD attributed the decline to an economic slowdown and rising geopolitical tensions. UNCTAD stated that a modest increase in worldwide FDI flows were possible in 2024, despite continued challenges that could thwart global investment.

Looking at foreign direct investment more broadly, international companies invest in the United States for many reasons. A list of positive factors includes the large U.S. market, world-class research universities, a stable regulatory regime, and a solid infrastructure that allows businesses to easily access the U.S. market. For certain international investors, the United States has become an important global export platform. Good domestic energy resources also draw international investors to the United States.

These investments benefit the American economy as international firms build new factories across the United States, buoy their well-established U.S. operations, fund American research and development activities, and employ 7.9 million Americans in well-paying jobs.

The United States was the world’s top destination for FDI in 2023, accounting for almost a quarter of the global total. Also, the United States remains the world’s prime location for international investment on a cumulative basis. Whether the United States will retain its status as the world’s most attractive investment location hinges on macroeconomic policy decisions, both in the United States and abroad.