Foreign Direct Investment in the United States, 2020-2023

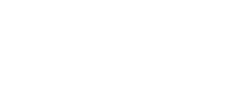

- Foreign direct investment in the United States (FDIUS) totaled $72 billion in the third-quarter 2023.

- Net equity flows registered $10 billion of the third-quarter 2023, composing 10 percent of FDIUS.

- Reinvestment of earnings was $61 billion last quarter or 85 percent of all FDIUS.

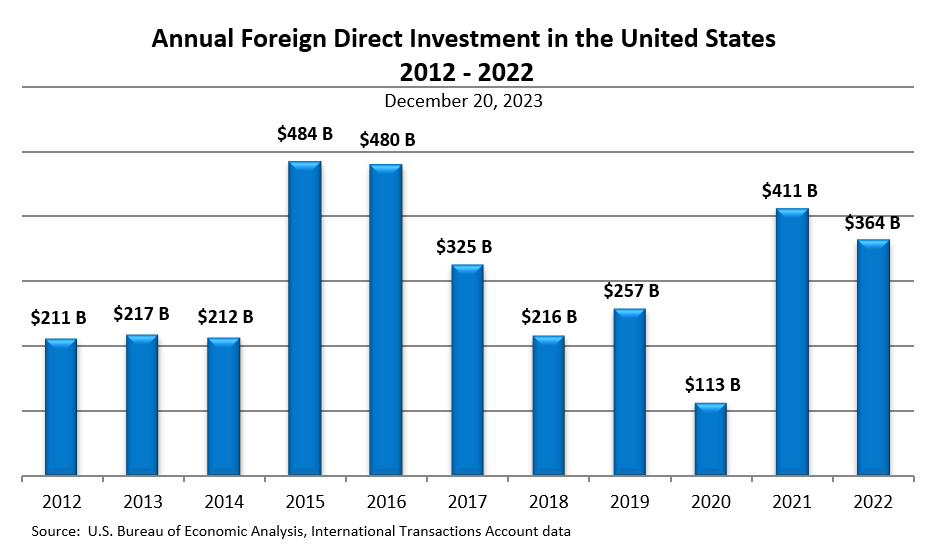

- Foreign direct investment in the United States in 2022 totaled $364 billion, making it the fourth-strongest year for FDIUS over the past decade. FDIUS reached record highs in 2015 and 2016, at $484 billion and $480 billion, respectively.

- Quarterly FDIUS flows are subject to large revisions and can fluctuate greatly from quarter to quarter.

- Despite increased global competition for foreign investment dollars as more countries position themselves as open and attractive investment destinations, the United States remains a prime investment market attracting capital and businesses to the United States that create new jobs across the American economy, bolster American innovation, and enhance American’s global competitiveness.

Analysis & Context

Third-quarter 2023 foreign direct investment flows in the United States totaled $72 billion, down 10 percent from second-quarter 2023. Reinvested earnings made up the largest portion of FDIUS at $61 billion, or 85 percent of total FDIUS. If current FDIUS trends continue in the fourth quarter, 2023 FDIUS will be slightly better than average for the past decade.

German companies led in FDIUS during the third quarter this year with $12 billion, followed by companies from Japan and the Netherlands.

At $26 billion, manufacturing was the largest industry benefitting from FDIUS in the last quarter. At the same time, wholesale trade and professional, scientific, and technical services were the second- and third-largest domestic recipient industries of foreign direct investment.

Foreign direct investment in the United States totaled $364 billion in 2022. The 2022 FDIUS level is the fourth-strongest of the past decade, down 11 percent from 2021.

Globally, inward FDI flows fell 12 percent between 2021 and 2022 to $1.3 trillion, according to the United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2023 (WIR23). Some factors affecting this decline were the global pandemic, the war in Ukraine, climate change, and general economic uncertainty. Looking to the future, UNCTAD expects a further decline in FDI in 2023.

Looking at foreign direct investment more broadly, international companies invest in the United States for many reasons. A list of positive factors includes the large U.S. market, world-class research universities, a stable regulatory regime, and a solid infrastructure that allows businesses to easily access the U.S. market. For certain international investors, the United States has become an important global export platform. Good domestic energy resources also draw international investors to the United States.

These investments benefit the American economy as international firms build new factories across the United States, buoy their well-established U.S. operations, fund American research and development activities, and employ 7.9 million Americans in well-paying jobs.

The United States was the world’s top destination for FDI in 2022, and cumulatively, the United States remains the world’s prime location for international investment. However, with heightened competition from other countries, the United States’ share of global investment shrank to 24 percent in 2022 from 28 percent in 2002. Whether the United States will retain its status as the world’s most attractive investment location hinges on macroeconomic policy decisions, both in the United States and abroad. But for the 11th year in a row, A.T. Kearney ranked the United States as number one in its recently released 2023 Foreign Direct Investment Confidence Index. Further, A.T. Kearney was more optimistic than UNCTAD, stating that “82 percent (of multinational companies surveyed) said they were planning to increase their FDI in the next three years.”